Pensions

Whether you’re nearing retirement or just starting out on your career, it’s important to plan for the future. In any case, if you’re working, you will be contributing to your retirement pension. The Swiss Constitution stipulates a three-pillar pension system:

1. State pension

2. Workplace pension

3. Private pension

The basic principle behind this structure is that the first pillar is sufficient to cover your basic needs only during retirement, the second pillar allows a decent standard of living, and the third pillar should enable you to enjoy the same standard of living as when you were employed without having to make significant sacrifices.

State pension (AVS/AHV)

The federal old-age, survivors and invalidity insurance is known as AVS in French or AHV in German, and is governed by the federal act and regulation on AVS/AHV (LAVS–RAVS in French/AHVG–AHVV in German).

Who is covered by AVS/AHV?

You are covered by AVS/AHV if you:

- Live in Switzerland, unless only for study or a short-term work contract or unless you hold a legitimation card; OR

- Work in Switzerland for longer than three months and earn more than 2300 CHF per year.

You start contributing to AVS/AHV at the age of 21 if you are employed, and continue contributing until your retirement. The standard retirement age is currently 65 for men and 64 for women, but a referendum is expected to be held soon on whether to increase the retirement age for women to 65.

How much are AVS/AHV contributions?

The way that your AVS/AHV contributions are calculated depends on your employment status:

- If you are not earning, your contribution is calculated on the basis of your assets and any benefits you receive, and will be somewhere between 503 CHF and 25 103 CHF per year*. You can check exactly how much you will have to contribute at the following website, available in French, German or Italian.

- If you are employed, your AVS/AHV contribution of 4.35% of your gross monthly salary, deducted from your pay automatically (you don’t have to do anything to set it up). Your employer matches this contribution, giving you a total contribution of 8.7%. You can calculate your contribution at the following website, available in French, German or Italian.

- If you are self-employed, a degressive contribution rate applies, ranging from a fixed minimum contribution of 503 CHF per year for those with annual incomes below 9600 CHF to the maximum contribution equivalent to 8.1% of your annual income if it exceeds 57 400 CHF*. You will also have to pay a small administrative fee to your insurance fund. You can calculate your contribution at the following website, available in French, German or Italian.

*Note that the monetary amounts stated here are those fixed for 2021 and change each year. The percentages, however, are fixed.

What are the AVS/AHV benefits?

AVS covers the following expenses, in order of priority:

1. Retirement pension;

2. Child benefit (if you still have dependent children after reaching retirement age);

3. Dependency benefit (allocation pour impotent, for retired people dependent on carers);

4. Contribution to the cost of a carer (who is not a family member);

5. Equipment (e.g. wheelchair).

After death, it covers:

1. A surviving spouse benefit;

2. An orphan* benefit.

*“Orphan” in this context refers to a someone who is a still a minor when one parent dies; a child who loses both parents is referred to as a “double orphan”.

How much is the retirement pension?

The amount of your retirement pension will depend on how long you have contributed for – if you have gaps in contributions, for example because you moved to Switzerland later in life, your monthly pension will be less than if you have a full career of contributions.

To calculate your retirement pension, you first need to work out your average annual income (the pension calculation basis) using the following formula:

Average annual income = Income declared to the AVS fund + any grants (educational or assistance) / years of contributions

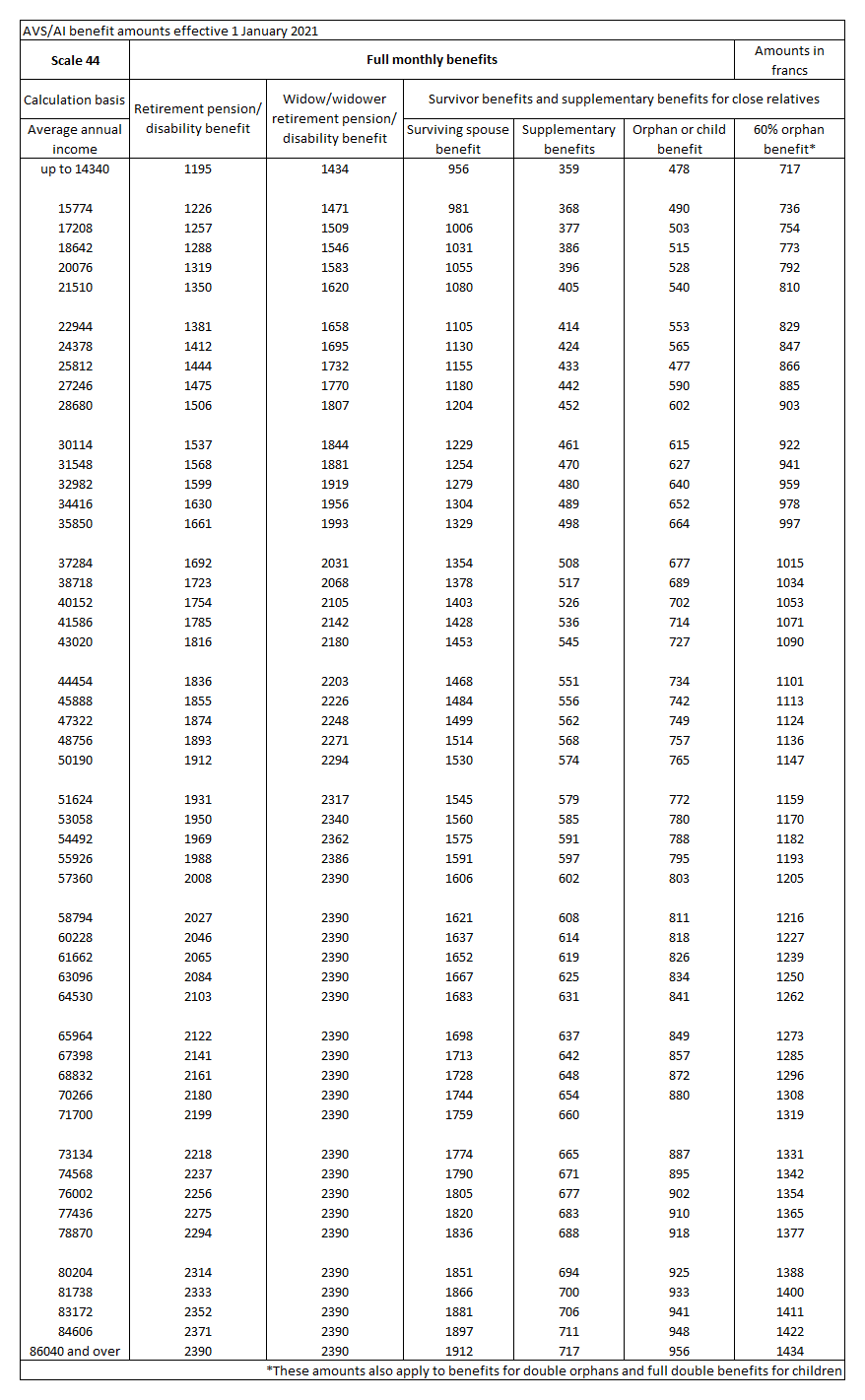

Then refer to “scale 44”, published by the Federal Social Insurance Office (OFAS) every year (it’s called 44 because a man with no gaps in contributions will have 44 years of contributions – from ages 21 to 65). The current scale is shown below by way of example: find your average annual income in the first column, and look across to see the amount of your pension and disability benefit or the benefits to which your family would be entitled.

Note that the calculation basis is capped at 86 040 CHF, so even if your income is higher, your monthly retirement pension would be capped at 2390 CHF.

Disability insurance and benefits (AI/IV)

In Switzerland, disability insurance and benefits (AI in French/IV in German) are assimilated into the state pension system outlined above. The federal acts on disability insurance (LAI in French/IVG in German) and social insurance generally (LPGA in French/ATSG in German) set out the contribution structure, the benefits available and the eligibility criteria.

It is important to note that disability insurance covers not only monetary benefits in the event of incapacity to work, but also measures to enable you to continue working (e.g. changes to your workstation) or resume work (e.g. medical treatments, training, equipment such as wheelchairs, etc.). In fact, you will become eligible to receive disability benefits to cover lost earnings only if all other measures have failed to allow you to resume work and earn the same amount as before.

Who is covered by AI/IV?

Everyone covered by AVS/AHV, whether obligatorily or voluntarily, is automatically covered by AI/IV.

How much are AI/IV contributions?

Your AI/IV contribution rate is 1.4% of your gross monthly salary if you are employed, but no less than 66 CHF per month. Like AVS/AHV, your employer matches this contribution, so the total contribution on your behalf is 2.8%.

If you are self-employed, your contribution depends on your income, according to the same scale as that applicable to AVS/AHV. In fact, the two are paid as a single contribution (which also includes loss-of-earnings insurance), and so the fixed minimum annual contribution of 503 CHF per year (in 2021) covers them both. The maximum contribution for revenues exceeding the upper threshold is 1.4%.

How does the law define disability?

The LPGA/ATSG defines disability as the complete or partial inability to earn money for a long period or permanently. It is important to note that, in the context of AI/IV, the focus is on your capacity to earn rather than your capacity to work – though the two notions are clearly linked, it may be that you are still able to work full time but are limited to jobs with lower earning potential than your previous profession. The primary purpose of disability benefits is therefore to ease the economic impact of an illness or accident that reduces your earning capacity in the long term.

How is my disability rate determined?

If you don’t work, your disability rate will be determined by specialists who will look at how able you are to carry out everyday tasks such as housework.

If you work, your disability rate is your lost earning capacity, which is calculated by deducting your potential income with your disability from your previous income (before the disability) to find your lost earning capacity as an amount. This is then converted into a percentage of your pre-disability income. For example, if you previously earned 50 000 CHF per year but now, due to disability, can earn only 30 000 CHF:

50 000 – 30 000 = 20 000

20 000 / 50 000 * 100 = 40 –> Your earning capacity has been reduced by 40%, so you are considered to have a disability rate of 40%.

This determination is somewhat complicated by the fact that it is not necessarily your actual new salary that is deducted, but rather what the AI Office believe that you could reasonably earn, and you may be expected to do a different job to what you did before.

If you work part-time, your disability rate is determined using a combination of the two methods described above.

What are the criteria for receiving disability benefits, and how much are they?

To be eligible to receive monetary disability benefits, you must have been unable to regain, maintain or increase your earning capacity or resume your usual tasks, even after the various adaptation measures have been put in place. In addition, you will become eligible only after a full year of at least 40% incapacity to work, and your incapacity must then remain above 40% in the long-term.

Our top tip: There is also a waiting period of six months after submitting your application to the AI/IV office before you can receive any monetary benefits, so apply after six months of incapacity to ensure that your payments will begin as soon as you reach the required full year.

Scale 44 shows the maximum benefits available depending on your average income over the course of your working life. If your disability rate (lost earning capacity) is below 70%, you will receive a fraction of the maximum:

| Disability rate | Fraction of the full benefit that you will receive |

| 40-50% | One quarter |

| 50-60% | Half |

| 60-70% | Three quarters |

| 70-100% | Full amount |

In addition to this benefit designed to compensate you for lost earnings, if you need a carer to assist you in going about your daily life, you may be eligible for a dependency benefit (allocation pour impotent).

Workplace pension (PP/BVG)

The workplace pension is the second pillar of the Swiss pension system, which is designed to guarantee you a good standard of living during your retirement.

Who has a workplace pension?

Employees subject to AVS who earn more than 21 510 CHF from the same employer are obliged to contribute to their workplace pension. Death and disability coverage applies only to employees over the age of 17, and retirement coverage to those over the age of 24.

Self-employed workers can subscribe to a workplace pension fund if they so choose.

Registered unemployed people are insured against death and disability.

What is insured?

The workplace pension insures the “coordinated salary”, which is the amount of your salary between the bounds of 25 095 CHF and 86 040 CHF. For example, if your annual salary is 21 000 CHF, it is not covered because none of it falls within the coordinated salary bounds:

| 21 000 | Minimum: 25 095 –> Coordinated salary –> Maximum: 86 040 |

On the other hand, if your annual salary is 99 000 CHF, which exceeds the upper bound, your coordinated salary is the maximum possible: 60 945 CHF (86 040 – 25 095):

| Minimum: 25 095 –> Coordinated salary –> Maximum: 86 040 | 99 000 |

(Note that these amounts are correct for 2021.)

What does my workplace pension cover?

Your workplace pension provides coverage in case of retirement, death or disability.

What is my pension capital?

Your pension capital is the money that you’ve saved through your workplace pension contributions throughout your career up until your retirement. At the end of each year, interest is added to this capital at a rate set by the Federal Council, along with a 1% age-based bonus.

The age-based bonus is a percentage of your coordinated salary, defined at a progressive rate depending on your age:

| Between the ages of 25 and 34 | 7% of your coordinated salary |

| Between the ages of 35 and 44 | 10% of your coordinated salary |

| Between the ages of 45 and 54 | 15% of your coordinated salary |

| Between the ages of 55 and 64/65 | 18% of your coordinated salary |

For example, say that you are 30 years old with a coordinated salary of 40 000 CHF and have accumulated 20 000 CHF worth of pension capital since you started working. Add to this interest (1% of 20 000) and the age-based bonus (7% of 40 000): 20 000 + 200 + 2800 = 23 000. You therefore go into the next year with a pension capital of 23 000 CHF.

How much will I get from my workplace pension?

By the time you retire, you should have accumulated a significant amount of pension capital. However, you are not guaranteed to receive the full amount, because the pension that you actually receive each year is a percentage of your total capital, at a rate set by the Federal Council each year. The current rate is 6.8%, so, for example, a retiree with a pension capital of 650 000 CHF receives an annual pension of 44 200 CHF (6.8% of 650 000).